Mutual fund investing has emerged as a popular wealth creation avenue for investors seeking professional management of their assets while aiming for optimized returns. Within the realm of mutual funds, asset allocation plays a significant role in determining fund performance and, consequently, your financial gains. The choice of asset allocation, which spreads investments across various asset classes such as equities, debt instruments, and other financial options, profoundly impacts mutual fund returns.

This article explores how asset allocation influences your Mutual fund returns, portfolio and examines its financial implications.

Understanding Asset Allocation

Asset allocation is the practice of dividing investments among different asset categories, such as stocks, bonds, and liquid cash. It is essentially a strategy aimed at balancing risk and reward within a portfolio. Investors typically choose their allocation based on their financial goals, time horizon, and risk tolerance.

In mutual funds, fund managers follow prescribed asset allocation guidelines to ensure the portfolio aligns with the stated investment objective. For example, equities-focused mutual funds allocate a major portion of their corpus to stocks, while debt-focused mutual funds emphasize corporate or government bonds.

Why Asset Allocation Matters for Mutual Fund Returns

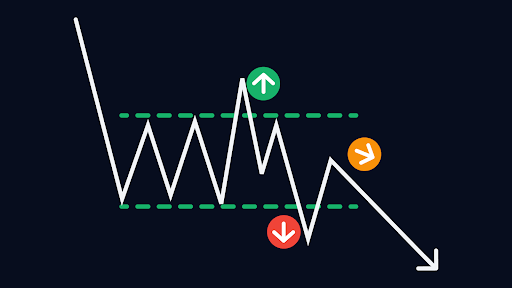

- Risk Management: Asset allocation provides diversification that reduces portfolio risks. By distributing investments across various asset classes, you avoid being overly exposed to a particular sector’s market volatility.

- Maximizing Potential Returns: Balancing high-risk, high-return assets with low-risk, stable-return assets optimizes mutual fund returns. For example, equity-based funds tend to generate higher long-term returns, while debt-based schemes provide consistent but limited income.

- Economic Cycle Adaptability: Different asset classes perform differently during varying economic cycles. A well-thought-out allocation is likely to weather market fluctuations better, thus impacting overall returns positively.

Impact of Asset Allocation on Mutual Fund Returns: Analysis

Let’s delve into examples and data-driven insights to understand asset allocation’s effectiveness.

- Equity-Dominated Allocation

Fund A: An equity-based mutual fund with 80% investments in equities (stocks) and 20% in debt instruments.

Performance assumptions:

– Average return on equities: 15% per annum.

– Average return on debt instruments: 6% per annum.

Calculation for ₹1,00,000 investment:

– Equity returns: 80% of ₹1,00,000 = ₹80,000 x 15% = ₹12,000.

– Debt returns: 20% of ₹1,00,000 = ₹20,000 x 6% = ₹1,200.

Total return: ₹12,000 + ₹1,200 = ₹13,200. Annual return = 13.2%.

- Debt-Dominated Allocation

Fund B: A debt-focused mutual fund with 80% investments directed toward government bonds and market instruments, and 20% in equities.

Performance assumptions:

– Average return on equity: 12%.

– Average return on debt: 6%.

Calculation for ₹1,00,000 investment:

– Equity returns: 20% of ₹1,00,000 = ₹20,000 x 12% = ₹2,400.

– Debt returns: 80% of ₹1,00,000 = ₹80,000 x 6% = ₹4,800.

Total return: ₹2,400 + ₹4,800 = ₹7,200. Annual return = 7.2%.

These examples reveal how asset allocation dictates fund performance. Equity-heavy mutual funds may provide higher returns in a bullish market but run the risk of unpredictability. Conversely, debt-focused funds offer steadier returns with limited exposure to volatility.

Key Insights from Historical Data

Considering returns from Indian mutual fund categories over a decade:

– Equity mutual funds, such as large-cap funds, delivered average annualized returns between 10%-15%.

– Debt mutual funds, such as gilt funds, offered annualized returns of 6%-8%.

– Balanced funds (hybrid allocation of equities and debts) produced annualized returns of 8%-12%, depending on their equity exposure.

A balanced asset allocation approach often cushions against the extremes of high-risk equity fluctuations while retaining moderate returns. Thus, asset allocation becomes a critical factor in determining how effectively mutual funds meet your financial objectives.

Factors Influencing Asset Allocation in Mutual Funds

- Investment Goals

Capital appreciation or wealth creation over the long term favors equity-heavy allocation, whereas income stability requires a debt-oriented strategy.

- Risk Tolerance

A conservative investor may prioritize debt or liquid funds, while risk-tolerant investors may shift towards mid-cap or small-cap equity funds.

- Market Conditions

Economic trends influence the performance of asset classes. For instance, during inflationary periods, debt instruments may underperform equities.

Challenges and Considerations in Asset Allocation

While allocating assets, one must be mindful of certain challenges:

- Market Timing Risks: Deciding when and how to rebalance an allocation may result in lost opportunities.

- Economic Factors: A sluggish global or domestic economy can impact the performance of asset classes.

- Taxation: Returns from mutual funds, especially equity-oriented ones, attract taxation. Long-term capital gains tax for equity mutual funds in India is 10% exceeding ₹1 lakh.

Summary

Asset allocation plays a crucial role in boosting mutual fund returns and managing risks in one’s portfolio. By diversifying investments into various asset classes like equities, debt instruments, and cash, investors can optimize returns while minimizing exposure to market volatility, including allocations to small cap mutual funds for higher growth potential. Allocation driven by historical data shows equity-heavy mutual funds generate higher returns over time but are riskier, while debt funds provide stability with lower yields. For instance, an 80% equity allocation provides around 13.2% returns, compared to a debt-heavy fund returning 7.2%. Factors such as investment goals, risk tolerance, and market conditions influence allocation strategies. However, challenges like taxation and timing risks need to be considered. Ultimately, effective allocation leads to balanced returns, protecting investors against economic cycles. As mutual fund investing involves uncertainties in the Indian financial market, individuals must thoroughly evaluate pros and cons before making decisions.

Disclaimer

Investing in mutual funds carries inherent risks, as markets are subject to fluctuations and uncertainties. Asset allocation is not a one-size-fits-all formula—investors must carefully analyze their risk appetite, financial goals, macroeconomic trends, and market risks. It is recommended to consult a financial advisor or study the scheme documents carefully before investing.