Retirement planning is a critical aspect of financial security. One of the most beneficial tools for Indian employees is the Employees’ Provident Fund (EPF), which serves as a corpus of funds accumulated over one’s working years. Regular EPF balance checks enable employees to ensure that their retirement strategy is on track, understand their financial standing, and make informed decisions about additional investments. This article explores the importance of EPF balance checks in retirement planning while touching upon related aspects such as checking claim status of PF and calculating returns.

Understanding EPF and Its Role in Retirement Planning

The EPF is a government-mandated savings scheme in India that requires both employer and employee contributions. A portion of the employee’s income (currently set at 12% of their basic pay) is deposited into the EPF account, along with an equivalent contribution by the employer. The funds accumulate over time, earning interest annually. The compounded interest can significantly boost your savings by the time you retire.

Benefits of Regular EPF Balance Checks

Tracking Contributions

A regular EPF balance check helps employees ensure that both their contributions and their employer’s contributions are being credited correctly. Sometimes, delays or errors may occur, such as an employer failing to deposit funds on time or a mismatch in salary details. By checking your EPF balance, you can detect such issues early and rectify them by approaching your employer or EPFO (Employees’ Provident Fund Organization).

Visualizing Growth

The EPF generates interest at rates decided annually (typically hovering around 8%). For example, if your annual EPF balance, including principal and accumulated interest, is ₹10,00,000 and the interest rate is 8%, your corpus would grow by ₹80,000 that year. Regularly checking your EPF balance allows you to see this growth over time. It gives you a clearer idea of how your funds are accumulating, which is critical for projecting your future retirement income.

Assessing Adequacy for Retirement

By keeping tabs on your EPF balance, you can evaluate whether the corpus being built is sufficient for your future needs. Suppose you estimate that you will need ₹50,00,000 for post-retirement expenses spanning 20 years. You can periodically check your EPF balance to analyze whether the current accumulation matches your expectations. If not, you might need to explore additional avenues such as mutual funds, Public Provident Fund (PPF), or National Pension Scheme (NPS).

Claiming PF and Addressing Irregularities

In the unfortunate case of an error or irregularity in your EPF account, checking your balance regularly will alert you early. Additionally, when the time comes to withdraw from your EPF (partial or full), checking the claim status of PF ensures transparency and timely resolution. Delays in withdrawals or claims can disrupt financial flow during emergencies or retirement.

EPF Balance Calculation Example

Let’s illustrate how EPF contributions can grow over time with a practical example.

Let’s assume:

– Basic Salary of the employee: ₹25,000 per month

– Employee Contribution (12%): ₹3,000 per month

– Employer Contribution (12%): ₹3,000 per month

– Annual Interest Rate: 8%

Yearly contribution:

Employee contribution: ₹3,000 × 12 = ₹36,000

Employer contribution: ₹3,000 × 12 = ₹36,000

Total yearly contribution: ₹36,000 + ₹36,000 = ₹72,000

If you start EPF contributions at age 25 and expect to retire at 60, then your investments will accumulate for 35 years. Assuming no changes in salary, here’s a simplified calculation:

– Total contributions over 35 years = ₹72,000 × 35 = ₹25,20,000

– Adding compound interest at 8% annually (without withdrawals), the matured fund will be approximately ₹1,02,02,000!

This calculation reveals the power of regular contributions and compounding interest when planning for retirement.

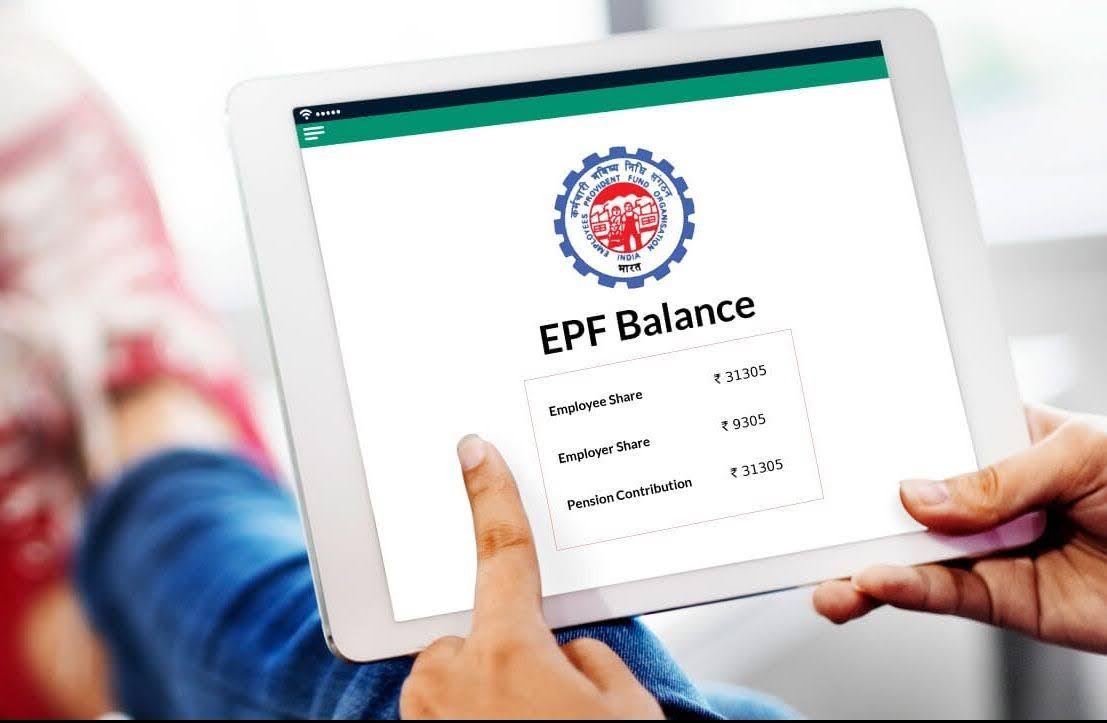

How to Perform an EPF Balance Check

Checking your EPF balance is convenient, thanks to digital platforms provided by EPFO. Methods include:

- EPFO Portal:

– Visit the EPFO website.

– Login using your Universal Account Number (UAN) and password.

– Check your balance under the “View Passbook” section.

- UMANG App:

– Install the UMANG app on your mobile device.

– Register with your credentials and check EPF balance easily.

- SMS Service:

– Send an SMS in the format “EPFOHO UAN ” to 7738299899.

- Missed Call Service:

– Give a missed call to 011-22901406 from your registered mobile number linked to your UAN.

Checking Claim Status of PF

Employees may need to withdraw EPF funds partially or fully in cases such as job changes, unemployment, or retirement. After applying for withdrawals, you can check claim status of PF using the EPFO portal or UMANG app.

Steps to check:

– Login to EPFO portal/UMANG app.

– Navigate to the claims section and track the progress of your request.

EPF’s Role in Your Larger Retirement Plan

While the EPF is a powerful tool for retirement savings, relying exclusively on it is risky. Inflationary trends and unforeseen expenses can outstrip savings. For instance, medical emergencies, family commitments, or economic downturns can deplete the corpus faster than anticipated. Therefore, while regularly checking your EPF balance, it is also essential to complement it with other investments like equity, PPFs, or NPS.

Tax Implications on EPF Withdrawals

The EPF offers tax efficiency, which further enhances its utility in retirement planning. Contributions, interest accrued, and withdrawals after five years of active service are usually tax-free. However, early withdrawals may attract taxes, reducing overall returns.

For example, if you withdraw ₹5,00,000 prematurely after four years of service, and ₹2,00,000 is taxable, the saving can reduce substantially depending on your income tax rate.

Challenges in EPF Management

While EPF is a reliable savings instrument, challenges include:

– Administrative issues: Errors in contributions or delayed updates can occur.

– Claim delays: Expenses such as medical emergencies may demand immediate withdrawals, where administrative delays could create difficulties.

– Inadequacy: A stagnant salary or discontinuous contributions could result in insufficient savings for retirement.

These challenges reinforce the importance of regular EPF balance checks and cautious financial planning.

Summary:

EPF balance checking is a simple yet invaluable habit that empowers employees to stay informed about their retirement funds. From tracking contributions to visualizing the impact of compounding interest, checking your EPF balance regularly ensures that your retirement goals remain achievable. It also helps address discrepancies and monitor claims efficiently. Alongside EPF balance checks, employees can secure post-retirement financial stability through complementary investments like mutual funds, PPFs, and NPS.

For instance, assuming a constant annual contribution of ₹72,000 and interest at 8%, an individual can accumulate over ₹1 crore in 35 years without withdrawals. Such disciplined monitoring enables a more secure retirement planning process.

Disclaimer:

This article is for informational purposes only. All calculations are simplified and based on assumptions. The investor must assess all pros and cons of investments, understand the intricacies of the Indian financial market, and consult financial experts to make well-informed decisions.